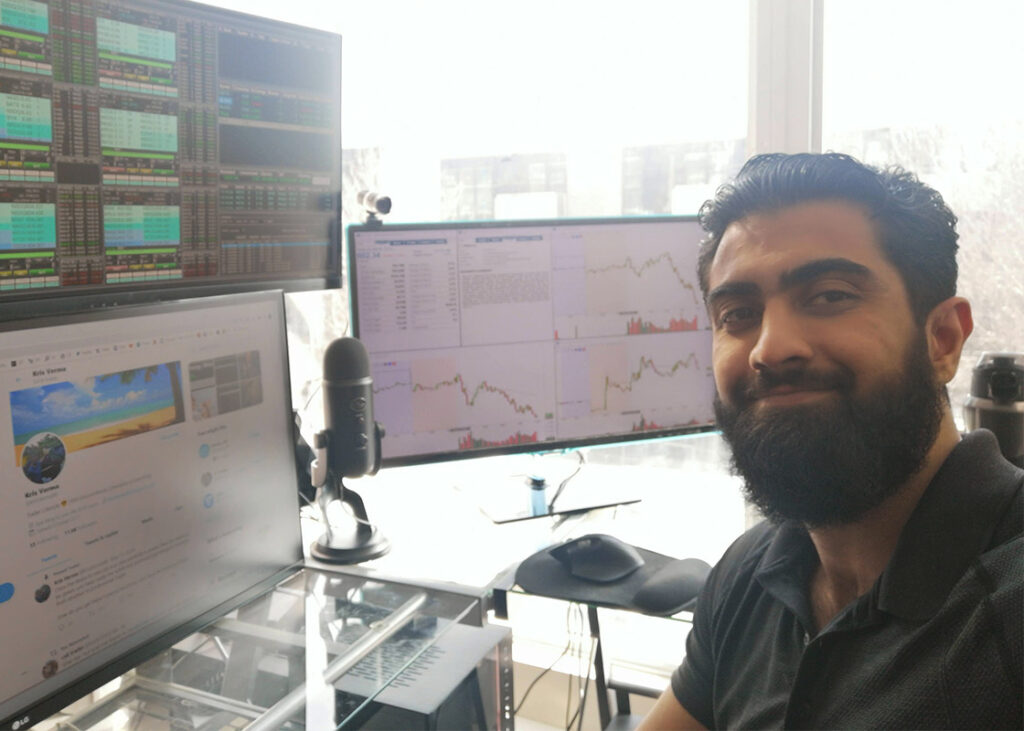

A few months ago we started intreviewing professional traders who use Tradervue to improve their performance. We have compiled these discussions in the first edition of Tradervue Conversations, a series of videos published on our YouTube channel. Our first guest is Kris Verma, professional day trader with a data-driven, mathematical approach to trading.

Kris is big on statistics and execution. In this interview you’re going to learn how he got started, how he trades, what he recommends traders – both beginners and experienced – do to improve their performance, and a lot more.

Feel free to either watch the video interview or read the transcript.

Table of Contents

How Kris Verma started and the markets he trades

Execution is everything – Kris’ motto

How Kris combines his background in sports betting with trading

Kris’ worst and best experiences

How to adapt to the current market conditions

What Kris does to improve as a trader and as a person

KVS: Kris Verma’s private Discord room

Kris Verma’s advice for developing traders

More Tradervue Conversations Coming Soon

Improve Your Trading Performance with Tradervue

Record your trades, analyze your performance, and share your notes to refine your trading strategies and consistently increase your profits.

Try it free for 7 days

Video interview

Watch our interview with Kris Verma here:

If you prefer to read, here is the video transcript:

How Kris Verma started and the markets he trades

Richard: Alright, so hello Kris. Welcome to the first edition of Tradervue Conversations. We’re happy to have you here and—yeah, how are you? How is it going?

Kris: I’m doing well, I’m enjoying my easter-long weekend. How about you?

Richard: Doing good, thank you. We’re really excited to have you here. So let’s kick it off. Tell us a little bit more about yourself: how did you start trading and what markets do you currently trade?

Kris: Okay, so I got back in trading in 2017 and I transitioned from a sports betting career, so that’s where I was, you know, making the majority of my money for about 10 years. But things change in the sports industry and then Covid hit, so I had to transition to something else, and that’s where I picked up stock trading.

And initially, I was a long side trader, but I didn’t find as much success with that so I switched to short selling and ever since then it’s just taken off. So five years now. I’ve had the same strategies since 2018 or so, I’ve just developed and perfected those so I’m really excited about how we’ve come along especially in this year, we really refined our strategies.

Richard: Nice, it’s interesting. And so Kris, I know you’re big on tracking statistics—you know, hard data—and also building edge and actually executing strategies around that. So how would you best describe your edge?

Kris: Well, our edge is derived from our databases that we track. So from the numbers and statistics that we run analyses on, we’re able to find mathematical edges that we can execute and apply to the market to make money consistently. And honestly, without that we wouldn’t have the conviction to put our money on these trades because we would be just guessing.

A lot of traders, I think, who are of the discretionary kind are just playing patterns, technical analysis, tape reading and those things—I’m not saying those methods don’t work, but I think there’s a lot of gray area and it takes a lot of experience. So the beauty of the discretionary systematic approach is that you can just apply it directly to the market, you don’t need much experience or screen time. And I feel you can make money right off the bat.

Richard: Yeah, I know, and that’s actually really refreshing. I would like to get a little bit deeper into that and how you do that if that’s okay, because from what I understand there are a lot of different approaches and it’s not like right or wrong approaches. It’s finding what best works for you if that makes any sense.

And so, with that being said, could you walk us a little bit through your process and actually getting deeper into what you see and how do you go about building a database, getting hard data, and then actually putting a strategy together that you can execute systematically?

Kris: Right. So what we do is we try to find the raw historical data from some sort of data provider or source— like Polygon is what we use. We use Python scripting to extract that data and then we extract it into Excel. Once we have a database, we can run formulas and we can use mathematics and statistics to analyze the data and try to find the statistical edge. And this is something I largely teach in my class, in one of my courses.

And the beauty of this approach is that it doesn’t take much technical skill or trading experience. If you can find the mathematics that work in the market, you just apply the trades and it’s very easy. It doesn’t take tape reading or entry skill. You just enter at a certain point, you exit at a certain point—you know, it’s very binary. It’s so easy to apply, that’s why beginners can have success with this approach. I’m very satisfied with how we’ve come across in 2022.

Execution is everything – Kris’ motto

Richard: Nice, it’s very interesting. So, I also know that you’re big on execution. One of the things you have on your Twitter description is that “execution is everything”. So tell us a little bit about how you got to that conclusion and how exactly do you take action based on that?

Kris: Right. So, like I just mentioned, that’s what we’re really focusing on in 2022. It’s focusing more on execution versus the P&L or the profits.

I think a lot of traders make the mistake of staring at their P&L all the time and always focusing on how much money they’re making and aren’t really concerned with executing their plan properly or following their system. And that’s where the profits come from. If you focus on that first, the money will flow in as a result, so that’s our approach and that’s what I learned throughout my career over the years. I learned that the less I focused on how much I was making and the more I focused on how I was trading, I tended to do better.

And I can find myself having a red day and not feel bad about it because I followed my rules, whereas most traders will have a red day and feel bad. They’ll have a green day and they’ll feel good even if they broke their rules doing it. So after rewiring your brain in a way to reward yourself for following your rules and punish yourself for breaking your rules despite what your P&L is. And that’s a very difficult thing to do.

Richard: Yeah, definitely. It kind of reminds me of a book called Atomic Habits from James Clear. There’s a part in which he mentions, uhm, I think it was something like “focus on the processes and results will follow”.

Kris: Yeah.

Richard: And yeah, a lot of people, like you mentioned, a lot of aspiring traders, at the beginning, they’re focusing more on the P&L and judging the day based on how they end either up or down on P&L. And it should be more towards execution; I do agree with you.

How Kris combines his background in sports betting with trading

Richard: So I’m guessing, Kris, that your historical background in sports betting gave you an analytical background into the markets. So can you tell us a little bit about how you combine or how you mix those two?

Kris: Right. So in sports betting, it’s basically the same approach. We get the data from sports sites, like statistics, team history, and those types of things. And then we try to find edges based on what has happened in the past because history will repeat itself.

So in stocks, you basically just get stock data from the market and try and run analyses on that. And [it’s] the same formulas that I would use: I was using Excel for over 10 years in my sports career. So it was actually easy for me to transition into stocks because it was all the same things, the numbers were the same, [but] we’re supplying in a different way.

What I found the most difficult was actually executing the trades because if you place a bet on a game, as soon as it’s placed your job is done, right? You can’t really do anything. But when you’re trading, you have all kinds of room to interject and sabotage yourself if you don’t have your emotions down.

So that was the thing I had to learn; it was controlling my emotions while in the trade. So those took a few years to perfect, but once it did, it was very easy to apply my skills from sports into stocks and make a considerable amount of money.

Richard: Nice, it’s very interesting. And, what if, for example—let’s say I’m a beginner trader, I’m just getting into the markets and I want to learn more about how to approach the market with this type of perspective or with this approach. How do I first get involved? What are the steps that I, as a beginner trader, should take to get my hands dirty with an approach like this? You know, hard data, more statistics?

Because when you come into trading, the first things you see, it’s indicators, technical analysis, and that’s kind of the normal approach and probably the most commercial approach if you will. So what is the first step, as a beginner, to get more involved in that type of approach?

Kris: Right, fair enough. I mean, I think it’s very difficult to get into this approach right away because it’s more abstract and it’s not commonly accepted in the trading community. So even to this point, I’m still having to convince people that what we do is successful.

But if you’re a beginner, what I would say is improve your Excel skills. We use Excel, spreadsheets, and formulas on a daily basis so—you know, I was self-taught in Excel, I learned everything online and didn’t take any courses. You can learn everything for free, just Google, research, put the work in, and prove your skills there.

And if you are able to, improve your coding skills because a lot of what we do is extracted with scripts like Python. So if you’re able to code or know someone who does code, you can extract the information a lot easier from these sources like Polygon.

There are some paid sources as well where you don’t have to learn how to code, but it’s just better if you can do it yourself because it gives more opportunities and freedom.

What I did when I first started trading was using Trade Ideas because they have a backtesting service. So I was backtesting ideas to see if they worked, and from that I was able to get the data to extract to Excel.

And from there I just kind of used my sports betting templates to run formulas, backtesting, and probability analyses to see if there was an actual quantifiable edge from that data. And what I found, Richard, was actually on the short side. There was such a strong edge on shorting these parabolic small cap stocks, or shorting gappers that were up 50% or more in the day. If you were just to short it at a certain point, hold it with a wide stop, and cover it at the close, the profits would come in month after month, whereas on the long side I was not able to find really any consistent strategies.

Richard: Okay. Wow, that’s interesting.

Kris’ worst and best experiences

Richard: So, moving a little bit into another topic. Can you tell us what could be a best and/or worst trading experience and what did you learn from in your years of trading career?

Kris: Okay *laughs*. I’ve got a few worst experiences that stick with you for years, I’ll tell you that. This is probably my second or third year in short selling, I was growing a small account and started with around five or ten thousand, and I grew my account up to around, I think it was eighty or ninety thousand, and I found myself in a short position on a stock, GBR. And it’s an energy play that’s recently been running.

So whenever that tick symbol comes up, it reminds me of this painful memory that I have a few summers ago. And what I did was that I was shorting the stock, and instead of respecting my stop walls I decided to swing overnight because I just felt “it’s gonna come down, I don’t want to cover here”. I was down like 30 or 40%. And I remember I didn’t sleep a minute that night; I was so anxious and nervous the next morning. And when I woke up I found out that it was gapping up huge before and my account was completely blown out and it was actually a negative balance where I owed my broker money. It was a very dangerous situation that I put myself in.

And you learn the most from these painful experiences. I think as a trader you have to have that gut-wrenching, painful experiences so you learn not to do it again because if I’ve never had that experience I probably would have learned later down the road not to do that. Respect your stops, don’t swing positions especially when you’re in the red. And the answer my broker had to close me out of the position, my account was totally blown, and it was really tough to swallow but I learned from it, overcame it, and obviously recovered—I’m here now, you know.

Richard: Yeah, I know. I mean, well it sounds tough.

Kris: Oh yeah, it was tough. *laughs*

Richard: And moving forward, what did you apply or what did you change for you to not have that experience again and be able to continue with your trading career? Because a lot of people could call it, after that kind of experience, some aspiring traders could not get back into the market. They could even get scared about putting a position after that, so tell us a little bit more about what you did or what learnings you got from it.

Kris: Right. Yeah, so a traumatic experience like that can really hurt your confidence and it definitely did for me because I was grinding up a small account and I was really putting some green months together and then having it all lost in one day is really demoralizing and hurts your confidence.

So I took a few months off—I needed to recoup some money as well—to process things and when I came back I started using hard stops. I didn’t let things get out of control anymore and I covered all positions at the end of the day. So I didn’t risk swinging because that memory was painful and fresh in my mind. I would always think “I don’t want to have that happen again” so I just got to get up and play it safe.

And I think you need those experiences to shape you and mold you and help you grow as a trader, otherwise you’re just gonna be reckless as I was as a beginner trader. I was trading very recklessly, but now I’m very controlled and a lot more disciplined than I was before.

Richard: Definitely. What about a best experience? Can you recall a best experience? You probably have had a few of those. Is there any good moment in your trading career that pops into your mind?

Kris: I had several moments, like an “Aha!” moment where it felt like I made it and it felt like I had realized something that took me to the next level as a progression as a trader.

And honestly, this year has been that kind of moment for me—the entire year. When I started this 100K account challenge back in December, it was because I was going sideways for several months, struggling to adapt to the post-Covid market and I felt like I needed a mental reset. I needed to improve my execution, so that’s why I emphasized my execution in my daily P&L posts.

I feel like most transparent Twitter traders don’t say anything about execution, it’s always about P&Ls, charts, stuff like that. So I felt like I wanted to emphasize that. And even my chat room guys are doing that themselves; they’re focusing more on their execution, that’s what we discuss in the room, not how much we made today, [but] all the rules that we follow in the system. And as a result, our guys are really successful and making progress as traders.

So I would say this entire year has been that kind of feeling for me, I just feel like a better trader, a more disciplined trader, and I’m excited to see where the rest of the year goes.

Richard: Yeah, definitely.

How to adapt to the current market conditions

Richard: So, Kris, a lot of friends of mine who are traders, and I can see it on Twitter and other social media spaces, are struggling to adapt to this post-Covid market. And so, what I’m trying to say is that what have you done in order to adapt to this market environment? Because it’s definitely not the same as it was in 2020-2021. I mean, we definitely had a huge run in 2020 because of all this quantitative and all the monetary situation in central banks and all that stuff. And so 2021 was like a good year, and kind of the same direction, but it also moved sideways in the last half of the year.

So can you share with us a little bit of your observations and what have you done in order to adapt to these market conditions?

Kris: Right, good question. This is something that we’ve actually worked a lot on because we noticed a major shift in the market after around March of last year. We feel like the organic liquidity in the market has dried up, and we see more manipulation and basically more fierce competition especially in this small cap realm. Like, who are we competing against? And it’s not those stimulus check people anymore, it’s more experienced traders. Guys who made it through that period and maybe algos, hedge funds, you know, tougher competition, so we had to step up our game as well.

So our main approach basically is trying to avoid those manipulated stocks where it’s basically a 50/50. The higher volume ones, over a million shares a day, ones that are clearly algo-controlled, we‘re trying to avoid those as much as possible and stick to the lower volume plays, under-the-radar plays, or low-hanging fruit as they call it. Because those plays are not gonna be as crowded, they’re not gonna be as trappy or manipulated, and we’re gonna have a better read or feel for what’s happening.

And I think a lot of traders are struggling because they’re still trying to find those crowded stocks and trying to find an edge when the competition is so tough. It’s like, whose money are you actually taking? Are you trying to take money from traders who are probably better than you, or probably have more resources than you, or more information than you?

So my philosophy is probably the same as poker players. You don’t want to play against the sharpest players, you want to play against the fish or the tourists, people who don’t know what they’re doing.

So what we’re doing is we’re trying to focus on lower-volume plays, plays that are not crowded, like, if you noticed I didn’t trade VERU much lately a lot of these crowded stocks that people are having trouble with. And I think that can do a lot of good for your trading as well because you’re not gonna be burned down mentally with all the manipulation and all the traps and things like that that can really fake you out. With lower volume there is less algo presence and it feels like it trades more cleanly and more organically.

Richard: I like what you just mentioned, like “whose money are you taking?”. I think it’s a really valid point you’re making because sometimes, you know, we don’t even think about who we are taking the money from. Trading is that trading, it’s actually money moving from one hand to the other, right?

So it’s a good question to ask, and, probably, if you’re gonna be trading something that’s crowded like you just mentioned, you’re gonna be against the sharpest traders out there, and they have more resources, and they have been also adapting and doing their homework. So I think it’s a really good point.

What Kris does to improve as a trader and as a person

Richard: And so, getting a little bit more into the trader mindset, Kris, and I think execution is part of this, but getting more into the trader mindset, kind of the growth mindset, what do you do on a daily basis to improve as a trader and also as a person? Because I believe both connect and they relate one to the other.

Kris: Right, good question. What we’re doing in 2022 is emphasizing execution, so that’s what we try to track every single day. I’m not staring at my P&L all the time, I’m trying to think “am I following the plan properly, am I sizing properly, am I holding properly?”. So every action that I take during the day, I ask myself“ Is this keeping my execution high or am I sacrificing it for what I’m about to do?”. I base all my decisions on that, tracking things religiously, like P&Ls, trades, entries, exits, we track everything to keep ourselves accountable.

Also, in the room we have a group Excel file where we can share our trades publicly within the group to kind of hold ourselves accountable and to be accountable to your peers and also to have support from your other trader buddies—I think that helps a lot.

Other things are just lifestyle choices: trying to eat better, going to the gym regularly. Just show discipline in other forms of your life and that will help or translate into your trading.

Richard: Yeah, and I do believe that also bleeds, either positively or negatively, into your trading for sure. I’m curious about what you track in your executions. I think I’ve seen an example before through Twitter. What variables do you keep in this execution sheet or what things do you track in order to get better and improve as a trader?

Kris: Okay. So what I track personally is trading only. It’s based on how well I follow my system. So we have a system that’s based on backtesting data: entry would be a certain price or certain criteria, or a certain size based on bankroll.

So if you size properly, if you take the right entry, if I don’t get in too early, if I hold it long enough, cover it at the right point, then you receive a 100% execution. But if any of those things were off then you’re deducting points for errors. I try to keep it very systematic and unbiased; that’s difficult to do sometimes because you’re rating yourself. It’s easier if someone else rates you, that’s why we have group execution in the room. We do these polls so that we can rate each other and hold each other accountable, because your most unbiased source is gonna be another person. So that’s what we’re trying to find, you know, that group effect can improve the execution as a whole.

Richard: Yeah, that makes sense.

KVS: Kris Verma’s private Discord room

Richard: So, as a beginner, advanced, or intermediate trader, if I want to join your group, what can I expect from that group? What things do you have available for the trading community?

Kris: Good question. Our group [Kris Verma Students] has grown quite a lot this year so we can prove our data tracking; we have Python webinars now, so you can learn how to do that. We have Excel webinars so you can learn how to track data and we have templates that you can use. You can paste in your own data and it will calculate the edges, the probabilities, and all that stuff for you. We have a library of webinars on trader psychology and order setups. Also, we share all of our historical data with the KVS database, so if you’re into data you can compare it to your own.

So our guys, what they do is they’re already systematic traders and they just want to confirm their own theories, possibly add edges to their own strategy with what we have.

But it also caters to complete beginners with no trading experience at all. You can come in, you can learn the strategies, you can execute them. And honestly, Richard, I find that traders with no experience do better in the room because they won’t have as much baggage or bad programming to unlearn. When they come into the room they don’t know anything so they just follow the rules so strictly whereas people who have been in a few rooms, they have all these ideas, they overthink, they over-complicate things and they always try to apply indicators and stuff when it’s really so simplistic.

And that’s the beauty of this system: you don’t need to over-complicate things. And usually less is more; that’s what we always say in the room.

Richard: Yeah, definitely. And I know it’s harder to unlearn than to actually learn the first time if that makes any sense. You come with preconceptions of this, this, and that, and that baggage, as you just mentioned, it’s hard to just unlearn all that and have to learn a new approach, it’s like a rewiring of your brain. I do agree with you on that.

Kris Verma’s advice for developing traders

Richard: And so, we’re starting to run a little bit out of time so to wrap it up, what word of advice do you have for developing traders or to those traders who are having a hard time during these changing market conditions?

Kris: Okay. I think the biggest thing is to have an edge, have a definable edge that works in all market conditions, and respect that edge. And the best way of doing that is by executing your plan.

I feel like a lot of traders sabotage themselves by trading differently, they change the plan mid-day, and they change their position sizing to make back losses. So just keep it as consistent as possible, respect your risk and your system, and let the power of the edge come through. Don’t try to force things.

Richard: Nice. Yeah, I think that’s great advice right there. So, Kris, where can listeners hear more from you?

Kris: They can check my website, KrisVerma.com, or they can check me on Twitter, it’s @KrisVerma88. I post pretty much every day.

Richard: Perfect. Alright, thank you Kris for being part of this first edition of Tradervue Conversations. I really enjoyed having you here, and also this conversation, and I hope to see you next time.

Kris: Thanks for having me, Richard.

Richard: Thank you Kris.

More Tradervue Conversations Coming Soon

We hope you enjoyed this conversation with Kris Verma and learned useful insights from it.

If you did, please consider liking our video, subscribing to our channel, and sharing it with other traders. We would also love to hear your thoughts in a comment below.

The first edition of Tradervue Conversations includes several more discussions with professional traders. We are going to release them soon, so keep an eye on them on this blog and our YouTube channel.

The traders we interview are all Tradervue users. If you are looking for an online trading journal that makes it easy to journal your activity, analyze your performance, and share your expertise with other traders, try Tradervue today for free.

Improve Your Trading Performance with Tradervue

Record your trades, analyze your performance, and share your notes to refine your trading strategies and consistently increase your profits.

Try it free for 7 days